A Profit First accountant operates based on the “Profit First” methodology, developed by Mike Michalowicz, which is a cash management system designed to help businesses prioritise profit and achieve financial health. Provided by the experts at Accounted For, here’s an in-depth look at how a Profit First accountant works:

1. Fundamental Principles

The Profit First system flips the traditional accounting formula of Sales – Expenses = Profit to Sales – Profit = Expenses. This means that profit is given priority, and expenses are adjusted to fit within the remaining funds. A Profit First accountant helps implement this methodology, ensuring that the business consistently allocates profit first before dealing with expenses.

2. Setting Up Bank Accounts

A key aspect of the Profit First system is the use of multiple bank accounts to allocate funds for different purposes. A Profit First accountant will help set up these accounts:

- Income Account: All revenue is deposited here.

- Profit Account: A predetermined percentage of income is transferred here to ensure profit is set aside.

- Owner’s Compensation Account: A portion of income is allocated for the owner’s pay.

- Tax Account: Funds are set aside to cover tax liabilities.

- Operating Expenses Account: The remaining funds are used for business expenses.

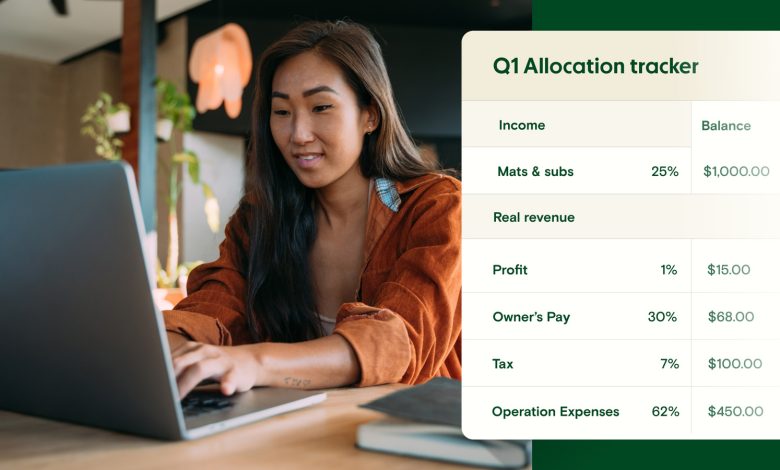

3. Allocating Funds

A Profit First accountant works with the business owner to determine appropriate allocation percentages for each account based on the business’s financial situation and goals. Regular transfers are made from the Income Account to the other accounts according to these predetermined percentages, ensuring that profit and other critical needs are prioritized.

4. Expense Management

By allocating funds to specific accounts, the Profit First system inherently restricts the amount available for operating expenses. A Profit First accountant helps the business review and manage expenses, ensuring they remain within the allocated budget. This often involves identifying and eliminating unnecessary costs, negotiating better terms with suppliers, and finding more cost-effective ways to operate.

5. Quarterly Profit Distribution

At the end of each quarter, the funds accumulated in the Profit Account are typically distributed. A Profit First accountant will guide the business owner on how to handle this distribution, which often involves:

- Retaining a Portion: Keeping a portion in the Profit Account as a reserve.

- Distribution: Distributing the remaining funds to the business owner as profit, reinforcing the habit of rewarding the owner for the business’s success.

6. Financial Analysis and Adjustments

A Profit First accountant continuously monitors the business’s financial health, analyzing cash flow, profitability, and expenses. They provide insights and recommend adjustments to the allocation percentages if needed, ensuring that the business stays on track to achieve its financial goals.

7. Strategic Planning and Advisory

Beyond managing the Profit First system, these accountants offer strategic financial advice. They help business owners understand the financial implications of their decisions, plan for growth, and navigate challenges. Their role includes:

- Forecasting and Budgeting: Creating financial forecasts and budgets that align with the Profit First methodology.

- Performance Metrics: Establishing key performance indicators (KPIs) to measure financial performance and identify areas for improvement.

- Growth Strategies: Advising on strategies for sustainable growth while maintaining profitability.

8. Education and Training

A significant part of the Profit First accountant’s role is educating business owners and their teams about the Profit First principles. This includes:

- Training on System Implementation: Ensuring that everyone involved understands how the system works and their role in maintaining it.

- Ongoing Support: Providing ongoing support and resources to help the business adapt and optimize the Profit First approach.

Conclusion

A Profit First accountant plays a pivotal role in transforming the financial management of a business. By prioritizing profit, setting up a structured system of bank accounts, managing expenses, and providing continuous financial oversight and strategic advice, they help businesses achieve consistent profitability and financial health. The Profit First methodology, when effectively implemented with the guidance of a knowledgeable accountant, can lead to more disciplined financial practices, greater financial stability, and ultimately, the long-term success of the business.